This week in The Tentacle for March 19 2009

Thursday, March 19, 2009

Jennifer Again?Patricia A. Kelly

I can’t believe she’s back – yet again. She says she’s running because she loves Frederick. A lot of us love Frederick, and we love it a lot more when she is not mayor.

Imitating a Junta…Tony Soltero

Back when I was a child, my parents once took a long, ambitious vacation to South America. When they got home they brought back countless little treasures from the countries they visited, an album's worth of beautiful photographs, and plenty of gripping stories to share. My brothers and I couldn't get enough of them.

Wednesday, March 18, 2009

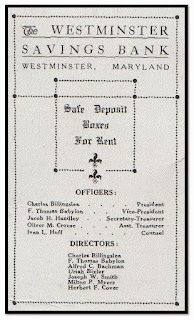

Think Globally, Bank LocallyKevin E. Dayhoff

If you are banking with any of the ginormous intergalactic financial institutions that are at the center of the current financial crisis, then you are part of the problem.

Budget Cuts Affecting Local Arts SceneMichael Kurtianyk

If current legislation is passed by the General Assembly, funding to the Maryland State Arts Council would decrease from $16.6 million to $10.6 million. This is on top of the 14 percent cut last year, used to balance the budget.

A $40 Million RuseTom McLaughlin

Batam Island, Indonesia – The islands were calling me and with rhythms of music from South Pacific flowing in my mind, I elected to visit a couple of them about an hour boat ride off the coast of Singapore.

Tuesday, March 17, 2009

Pushkin's Winter of DiscontentRoy Meachum

Mother Nature and government frequently disagree. Washington told us clocks must be turned back February's last weekend. A sure sign of Spring? The season doesn't begin until three weeks later.

Exhibiting America’s TraitsNick Diaz

There was a time when one, in the world of machines, could hardly hear two dirtier words than “Planned Obsolescence.” The very idea that a complex mechanical object should have a deliberately abbreviated life expectancy was nothing less than a kind of mortal sin against proper engineering.

Monday, March 16, 2009

General Assembly Journal 2009 – Volume 8Richard B. Weldon Jr.

Granting Personhood! Yes, I know what the editor is saying. What a terrible example of poor grammar in an opening. Unfortunately, I don’t make this stuff up, I just write about it!

Where’s the “Ownership,” Mr. President?Steven R. Berryman

During the election cycle of 2008 it became the standard rhetoric for candidate Barack Obama and his wife to distance themselves from the elements of what it meant to “be American.”

Friday, March 13, 2009

"Pope Admits Mistake"Roy Meachum

That semi-apology appeared in The New York Times. The rest of the headline narrowed the impact considerably; the admission came "In Letter to Bishops."

I Still Pledge My AllegianceJoe Charlebois

Sarah Norris, a columnist for The Frederick News-Post, on February 28 submitted a column which gave us an insider’s view of early morning at a Frederick County high school. Ms. Norris describes the scene of fellow students ignoring the morning ritual of patriotic recitation that American students have recited for decades – the Pledge of Allegiance.

Thursday, March 12, 2009

Waking Up The PopulaceJoan McIntyre

Are we about to see cracks in the glass ceiling in the world of our Frederick County Board of Education and Frederick County Public Schools? Will the Sacred Cow called the public schools system be held accountable?

REVIEW – Riverdance" Has It All!Roy Meachum

While being amazed in Baltimore's Hippodrome Theatre Tuesday night, the thought occurred: In my 40-plus years reviewing I've never seen a smoother musical show. Put simply: "Riverdance" has it all!

True Measure of SuccessChris Cavey

Our society has many ways to gauge the success or failure of those involved in the political world. One unique measurement of judging those who have mounted the national platform of “being someone of note” is to be a host or to be lampooned on Saturday Night Live. Last Saturday Michael Steele made it.

Wednesday, March 11, 2009

The Dangerous Diplomacy of PanderingKevin E. Dayhoff

I recently had the delightful opportunity to go to Washington and have lunch with a member of the Estonian Parliament, Tõnis Kõiv.

The Weavers and the MoneyTom McLaughlin

Lombok, Indonesia – We had finished our visit with the stump tailed Macaques and the use of my teaching techniques on the troop. Our next stop, a small enterprise, located only through a side road, winding through a housing estate filled with homes (we would call them shacks) constructed of wood.

Bobby Fischer: Genius or Madman?Michael Kurtianyk

It has often been said that there’s a fine line between genius and madness. Think of some people whom you consider to be geniuses? Does Albert Einstein come to mind? Thomas Jefferson? Benjamin Franklin?

Tuesday, March 10, 2009

GOP Spitting ContestRoy Meachum

As a non-Republican, I find amusing the recent rhubarb within the GOP party over Michael Steele.

Misinformation and Playing PoliticsFarrell Keough

Some interesting events have occurred over the last few weeks that are seemingly disparate, but in fact, have many commonalities. The main connection is the discussion of the Waste To Energy (WTE) plant.

20090319 This week in The Tentacle for March 19 2009